Overview Table

| Aspect | Details |

|---|---|

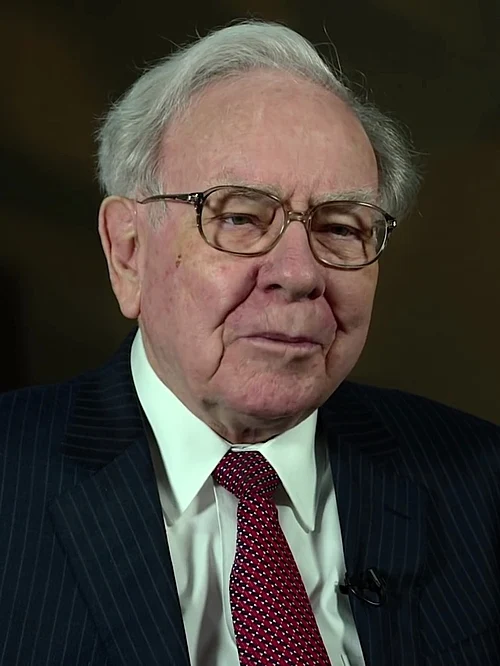

| Full Name | Warren Edward Buffett |

| Born | August 30, 1930, Omaha, Nebraska, USA |

| Known As | “The Oracle of Omaha” |

| Profession | Business Magnate, Investor, Philanthropist |

| Current Role | Chairman and CEO of Berkshire Hathaway |

| Net Worth (Approx.) | Among the world’s top billionaires |

| Education | University of Nebraska (B.S.), Columbia Business School (M.S. in Economics) |

| Famous For | Value investing, simplicity, long-term vision |

| Philanthropy | The Giving Pledge, Bill & Melinda Gates Foundation |

| Core Philosophy | “Price is what you pay, value is what you get.” |

Introduction: The Making of a Modern Financial Philosopher

Warren Buffett is not just a name; he is a living institution in the world of finance. For over seven decades, he has exemplified what it means to combine intelligence, patience, and ethics in the pursuit of wealth. Often called “The Sage of Omaha”, Buffett transformed from a newspaper-delivering teenager to one of the world’s most respected billionaires and philanthropists.

His influence stretches far beyond investing. He is a teacher of human behavior, decision-making, and rationality. Buffett’s approach is not rooted in flashy trading or speculation; instead, it thrives on discipline, deep understanding, and timeless principles. He once said, “The stock market is designed to transfer money from the active to the patient.” That single line defines his entire philosophy — a belief that long-term thinking always outperforms impulsive moves.

Buffett’s life story is not about luck but about consistency. He stands as living proof that financial success and moral integrity can coexist harmoniously. In a world obsessed with speed, Warren Buffett’s slow, thoughtful, and deliberate path to success remains a beacon of wisdom.

Warren Buffett Early Life: The Numbers Whisperer from Omaha

Warren Edward Buffett was born in Omaha, Nebraska, in 1930, during the Great Depression. His father, Howard Buffett, was a stockbroker and later a U.S. Congressman, while his mother, Leila, was a homemaker. From a very young age, Warren displayed an extraordinary fascination with numbers and business.

At just six years old, he bought six-packs of Coca-Cola for 25 cents and sold each bottle for a nickel, making a small but memorable profit. This early entrepreneurial spark became a lifelong trait. By the time he was 11, he had already purchased his first stock — three shares of Cities Service Preferred — marking the beginning of his investing journey.

He observed how markets behaved, not through theory, but by living through their ups and downs. His childhood wasn’t filled with luxury, but it was rich in curiosity. He read financial pages as others read comic books. The more he learned, the clearer it became that his destiny was tied to numbers, businesses, and human psychology.

Warren Buffett Education and Mentorship: Learning from the Best

Warren’s formal education began at the University of Nebraska, where he completed his undergraduate studies in business administration. However, the real turning point came when he discovered Benjamin Graham’s classic “The Intelligent Investor.” The book reshaped his thinking, introducing him to the concept of value investing — buying undervalued companies with strong fundamentals and holding them patiently.

Determined to learn directly from Graham, Buffett applied to Columbia Business School, where Graham taught. Under Graham’s mentorship, he absorbed the essence of disciplined investing. He also developed his own twist on Graham’s philosophy — focusing not just on undervalued stocks but on wonderful companies at fair prices.

Graham gave Buffett the framework, but Buffett added intuition, emotional control, and long-term vision. After graduating, he offered to work for Graham’s firm for free, showcasing his humility and hunger for learning. This period shaped him into not just an investor but a philosopher of money.

Warren Buffett The Early Ventures: Seeds of an Empire

Buffett’s first professional step came when he started Buffett Partnership Ltd. in 1956 with just $105,000, collected from friends and family. His disciplined approach soon produced remarkable results, consistently outperforming the broader market.

He focused on companies that others ignored — those undervalued or misunderstood. Each investment was a calculated move, guided by logic, not emotion. His ability to analyze financial statements, assess management quality, and foresee long-term value made him stand out even in his early years.

By 1965, Buffett had gained control of a struggling textile company called Berkshire Hathaway. Most saw it as a failing enterprise; Buffett saw a hidden opportunity. Over time, he transformed Berkshire from a dying textile mill into a massive holding conglomerate that today owns or holds stakes in companies like GEICO, Coca-Cola, American Express, Apple, and more.

Warren Buffett Berkshire Hathaway: Building a Legacy of Trust and Value

Berkshire Hathaway is more than just a company — it’s an ecosystem of businesses bound by Buffett’s philosophy. Instead of chasing short-term profits, Buffett focuses on long-term ownership. He acquires companies with strong brands, ethical leadership, and sustainable competitive advantages — what he famously calls “economic moats.”

Under his leadership, Berkshire has become one of the world’s most admired corporations. Its subsidiaries span insurance, energy, railroads, manufacturing, retail, and technology. But the most remarkable part isn’t its size — it’s its culture. Buffett’s management style is built on decentralization and trust.

He empowers managers to run their companies independently, saying, “We can afford to lose money, but we can’t afford to lose reputation.” This trust-driven model has fostered unmatched loyalty and innovation across the Berkshire family.

Today, Berkshire is valued in hundreds of billions, yet Buffett still lives modestly in his Omaha home, drives a regular car, and eats at McDonald’s. His lifestyle symbolizes his core message: wealth is not about extravagance; it’s about freedom and discipline.

Warren Buffett Investment Philosophy: Simplicity Over Complexity

At the heart of Buffett’s genius lies his ability to simplify the complex world of finance. His investment philosophy revolves around timeless principles:

- Value over price: He looks for companies trading below their intrinsic value.

- Circle of competence: He invests only in businesses he understands.

- Long-term mindset: He prefers holding forever, rather than trading frequently.

- Strong management: He values integrity and competence in leadership.

- Economic moats: He invests in companies with durable competitive advantages.

- Patience and discipline: He avoids market noise and emotional reactions.

He once said, “Be fearful when others are greedy, and greedy when others are fearful.” This contrarian approach has guided him through multiple market crashes and recoveries.

Buffett also emphasizes emotional intelligence. He believes successful investing is not about IQ but temperament — the ability to stay calm under pressure and resist herd behavior.

Warren Buffett Partnership with Charlie Munger: The Twin Pillars of Rationality

Warren Buffett’s partnership with Charlie Munger, his longtime friend and vice chairman of Berkshire Hathaway, is one of the most iconic duos in business history. Munger’s intellectual depth and philosophical insight perfectly complemented Buffett’s analytical discipline.

Together, they refined value investing into a broader philosophy. Munger encouraged Buffett to move beyond “cigar-butt” investments (cheap but mediocre businesses) and focus on high-quality companies. This evolution transformed Berkshire Hathaway’s fortunes.

Their friendship is built on honesty, humor, and mutual respect. They are proof that intellectual partnership can produce extraordinary results when grounded in shared values. Munger once said of Buffett, “He’s the best learning machine I’ve ever seen.” Buffett, in turn, often calls Munger his “partner in thought.”

Warren Buffett Leadership Style: Trust, Integrity, and Empowerment

Unlike typical CEOs who chase quarterly targets, Buffett leads with patience and purpose. His leadership is rooted in trust. He hires competent people and lets them operate freely, holding them accountable only for integrity and results.

He writes an annual letter to shareholders that has become a masterclass in business wisdom. Each letter reveals his thought process — candid, humble, and insightful. Buffett treats shareholders as partners, not just investors. He believes transparency builds long-term trust, which is the foundation of sustainable success.

Buffett’s humility is legendary. Despite his status, he avoids unnecessary publicity and often credits his team and luck for his success. His leadership mantra is simple: “It takes 20 years to build a reputation and five minutes to ruin it.”

Warren Buffett Lifestyle and Personality: Wealth with Simplicity

For a man whose fortune exceeds $100 billion, Warren Buffett’s lifestyle is astonishingly simple. He still lives in the same Omaha home he bought in 1958 for $31,500. He loves Coca-Cola, eats ice cream for breakfast, and enjoys bridge more than luxury yachts.

This humility isn’t an act — it’s his authentic nature. He once said, “I measure success by how many people love me.” To Buffett, true happiness doesn’t come from money but from relationships, learning, and integrity.

His grounded life sends a powerful message in a world obsessed with materialism. It shows that contentment comes from self-awareness, not accumulation.

Warren Buffett Philanthropy: The Giving Pledge and Beyond

Warren Buffett’s generosity matches his success. In 2006, he announced plans to donate over 99% of his wealth to philanthropic causes. Most of it goes through the Bill & Melinda Gates Foundation, focusing on health, education, and poverty eradication.

Along with Bill Gates, Buffett co-founded The Giving Pledge, encouraging billionaires to commit at least half of their wealth to charity. The movement has inspired hundreds of global philanthropists to follow suit.

Buffett believes that wealth is a responsibility, not a privilege. He famously stated, “If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.”

His giving reflects not just generosity but gratitude — a recognition of how society contributed to his success.

Warren Buffett Famous Quotes: Timeless Words of Wisdom

Warren Buffett’s wisdom extends beyond finance into life philosophy. Some of his most quoted sayings include:

- “The best investment you can make is in yourself.”

- “It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours, and you’ll drift in that direction.”

- “Our favorite holding period is forever.”

- “Risk comes from not knowing what you’re doing.”

- “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

Each of these quotes reflects his deep understanding of time, patience, and long-term thinking.

Warren Buffett Influence on Modern Investing

Buffett revolutionized the way people perceive investing. He demystified Wall Street jargon and brought investing back to its essence — buying good businesses at fair prices. His annual meetings in Omaha attract thousands of shareholders from around the world, turning into a festival of learning and insight.

His strategies are now studied in universities, his letters are quoted in textbooks, and his decisions move markets. Yet, Buffett insists that his approach is not about brilliance but about avoiding mistakes. “I just try to be consistently not stupid,” he jokes.

Through his example, he’s taught generations that real wealth is built slowly, with patience and principle — not speculation.

Warren Buffett Buffett’s Rules for Success: A Blueprint for Life

- Think long term: Avoid short-term distractions; compound your results over decades.

- Live within your means: Frugality breeds freedom.

- Learn constantly: Read daily; curiosity keeps you young.

- Choose integrity over opportunity: Reputation is priceless.

- Invest in people: Great businesses are built by great leaders.

- Be patient: Time is the friend of the disciplined investor.

- Give back: Success without contribution is incomplete.

Buffett embodies these principles not just in his work but in his life.

Warren Buffett Legacy: The Oracle’s Enduring Impact

Warren Buffett’s legacy goes beyond money. He redefined capitalism with a conscience. His model of ethical capitalism shows that profit and principle can coexist.

Future generations will remember him not just as a billionaire but as a teacher — one who made the world understand that simplicity, honesty, and patience are the real foundations of success.

As he once said, “You can’t build a reputation on what you’re going to do.” Buffett did not just preach these values; he lived them — every single day.

Conclusion: The Timeless Power of Wisdom and Integrity

Warren Buffett’s story is not about financial genius alone; it’s about character, integrity, and human insight. From selling Coca-Cola as a boy to leading one of the most valuable companies in the world, he has stayed true to his principles.

His teachings are universal — whether you’re an investor, entrepreneur, or student of life. He teaches us that success is built not through luck or shortcuts but through knowledge, patience, and ethics.

In a world that often celebrates speed and greed, Warren Buffett remains a symbol of calm, reason, and moral clarity. His life reminds us that wealth is not about what you own, but about what you value.